Serving clients across Ontario. From Toronto to Chatham and beyond — expert accounting made affordable. Powered by our expertise in virtual and remote solutions, we deliver big-city expertise at small-town rates.

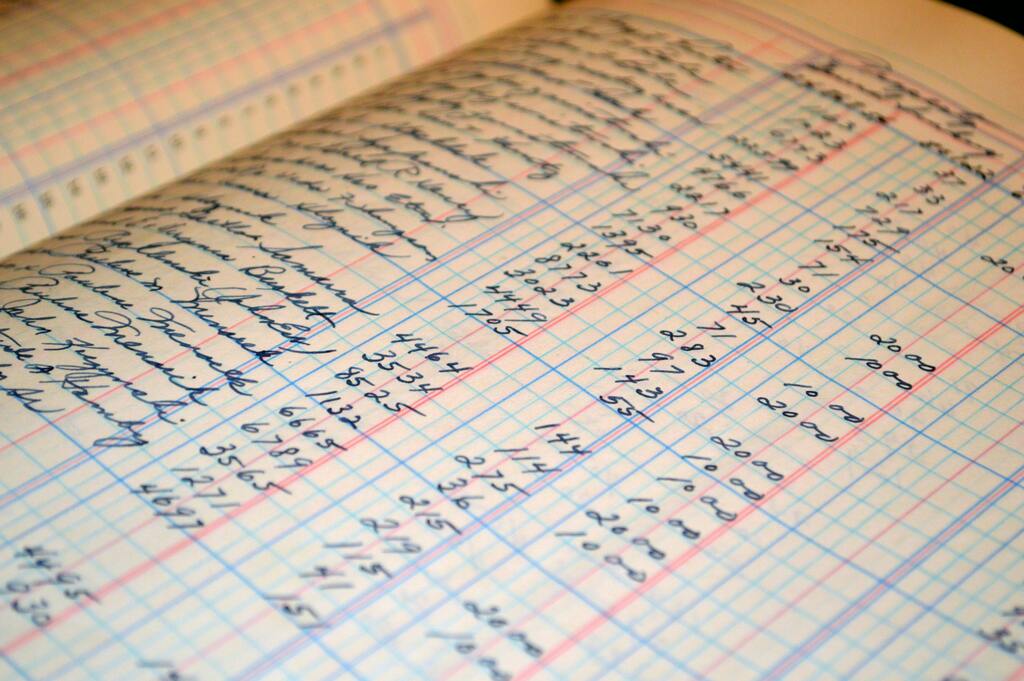

We manage your books so you can manage your business. From reconciliations and payroll to HST filings and year-ends, we keep everything accurate and on time. Our team ensures your financial records are audit-ready and fully compliant.

Our bookkeeping and accounting services are designed to take the pressure off business owners. We handle everything from daily transactions, payroll, and HST filings to month-end reconciliations and year-end reporting. With decades of experience and a commitment to accuracy, we ensure your books are clean, up-to-date, and ready for tax time. Whether you need basic bookkeeping or full-cycle accounting, our team keeps your financial foundation strong.

Let us act as your internal accounting team—without the overhead. We provide controller-level oversight, financial reporting, and full-cycle accounting. It's like having an experienced CFO on call, whenever you need us.

For businesses that have outgrown basic bookkeeping but don’t need an on-site controller, our outsourced financial department is the perfect solution. We integrate seamlessly with your team to manage everything from day-to-day accounting to cash flow analysis, budgeting, and financial reporting. With flexible service plans and deep expertise in corporate compliance, we offer strategic oversight and back-office support that scales with your business. It's a cost-effective way to gain professional financial management without hiring in-house.

We make personal taxes simple, accurate, and stress-free. From basic returns to self-employed and rental income, we’ve got you covered. Our team is available year-round—not just at tax time.

We understand that tax season can be overwhelming, which is why we provide personalized T1 tax filing services that prioritize accuracy, timeliness, and clarity. Whether you're filing a straightforward return, reporting self-employment income, claiming rental properties, or managing investments, we ensure everything is properly filed and optimized. More than just a seasonal service, we're available year-round to answer questions, handle CRA inquiries, and support your evolving tax needs. It's personal tax filing—with professional support.

We take the stress out of year-end by preparing accurate financial statements and filing your T2 corporate return on time. Our team handles shareholder dividends, salary planning, and CRA-ready working papers. With HBA, your year-end is efficient, compliant.

Our Corporate Year-End Accounting services provide a complete package for incorporated businesses. We compile accurate financial statements, prepare your T2 corporate return, and assist with planning around shareholder dividends and owner-manager compensation. Our working papers and documentation are always prepared to CRA standards, so you're ready in case of review. Whether you're a growing business or a well-established corporation, we ensure your year-end wraps up cleanly and confidently.

We handle your payroll from start to finish—accurately, on schedule, and fully compliant. Our services include ROEs, source deductions, WSIB, and year-end T4 and T5 slips. You can trust us to pay your team and meet every deadline.

Payroll can be one of the most time-sensitive and compliance-heavy aspects of running a business. HBA provides full-cycle payroll services, including scheduled payroll calculations, direct deposit, Records of Employment, WSIB filing, and source deduction remittances. We also prepare and issue T4s, T5s, and related year-end summaries, ensuring accuracy and CRA compliance. With our team managing your payroll, you can focus on your business while knowing your team is paid correctly and on time.

When the CRA comes knocking, we stand by your side. From audit prep and document review to direct communication with the CRA, we handle it all with professionalism and discretion. We help you stay compliant and reduce risk—every step of the way.

CRA reviews can be stressful—but with HBA on your side, you’re never facing them alone. We provide full preparation services, including document review, working paper assembly, and chain of custody support for sensitive files. Our team can liaise directly with CRA agents on your behalf, ensuring accurate responses, minimized penalties, and smooth resolution. We also advise on proactive compliance so you're not just reacting to reviews—but avoiding them in the first place.